In this article, I'll explain what the different payment methods accepted in London and any related fees.

Here you'll find

- An overview of payment options in London

- The advantages and disadvantages of each

- Associated fees and costs

- And much more!

If you're looking for the best way to pay in Londonyou'll love this article.

Follow the guide!

What's the best way to pay in London? Article summary

What's the best way to pay in London?

It's a safe bet that you'll be frequenting shopping districtsDiscover the best cafés, pubs and restaurants during your stay in London.

This means that you'll spend your moneyin local currencySo you need a suitable payment method. But which is the most convenient? The one that allows you to avoid costs and make transactions as quick and easy as possible?

One thing you should know: there's no point in weighing yourself down. coins and banknotes if you're staying in the capital: it's all digital! And yes, the city is way ahead of the rest of Europe, and currency already seems to have been relegated to the status of a relic.

So what should you use during your trip? I present to you the best payment optionsto avoid charges and settle your bills easily.

Classic bank cards

You can pay for your purchases with a classic bank cardprovided by your bank, via the Visa and MasterCard networks. A universal solution, to be sure, but subject to fees that depend on your bank.

Given that London (and England) is not in the E.U. or the euro zone, traditional banks take great pleasure in charging fees that are sometimes substantial. These can range from from 1 euro to 3 euros per transaction (!), plus variable costs that can reach 3 %. That's enough to make you lose a lot of money on a complete stay.

In some banks, monthly (international) options allow you to avoid paying these fees, provided you subscribe to offers costing around ten euros/month. Unfortunately, not all banks offer these options.

- Benefits: accepted everywhere; extended payment limits

- The minuses: very high fees

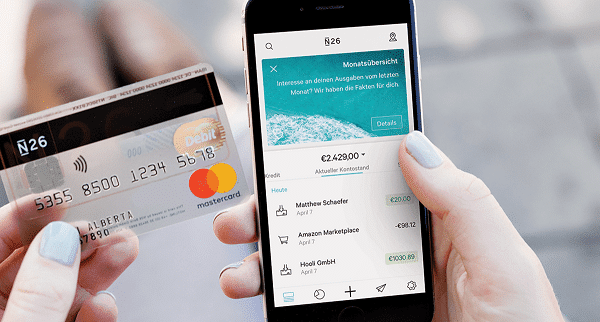

Mobile neo-banks

Neo-banks are a preferred solution for travellersWe're here to help you, digital nomads and those who tend to set up shop in different countries on a regular basis.

These multi-currency signs allow you to pay in local currencyIn some cases, withdrawals are free of charge (up to a certain amount). Sometimes withdrawals are 100 % free (up to a certain amount), sometimes they are subject to a few exchange rates.

However, they remain very advantageous when compared with traditional banks. The best-known and most reliable neo-banks include : N26, Wise and Revolut.

These are modern payment methods that have adapted to the new international needs of consumers. And you can use a Revolut or N26 card. from a smartphonewithout even waiting to receive the card at home.

- Benefits: No account maintenance fees; payment in local currency free of charge; 100 digital %; functional dedicated applications; insurance included; can be used immediately before receiving the physical card.

- Minus: you have to pay for the card (less than 10 euros)

Digital payment solutions

During your trip to London, you'll see that most people use their smartphone to pay. Whether it's to get through the metropay for a purchase at the supermarket or pick up the bill at the restauranteverything is done via services such as Apple Pay or Google Paycontactless.

If this is a very convenient solution, it's simply a case of extending your credit cardsubject to the same fees and payment limits, which depend on your bank and your means of payment.

- The + : Convenient ; accepted everywhere in London ;

- The minuses: the same fees as for payment by credit card

Species?

Although this may disappoint collectors of foreign currencies and those who like to feel what they're spending, cash is well and truly disappearing in London. Everything has been digitized, and even if you still come across signs reading cash onlyThis will soon be a thing of the past.

On the other hand, if you plan to explore the countryYou may need cash on your way out of the capital. What's more, when it comes to tipping, it's still very practical!

- The pluses: still useful in many small towns in England / outside the capital; the currency is pretty!

- The minuses: less and less accepted, even in major chains

Practical tips and information for paying in London

Here's some additional information to help you find the best way to pay in London, according to your needs and expectations.

How can I pay in the UK free of charge?

Among the options available to avoid paying fees when transacting in the UK are:

- A transfer from your account, in local currency, when authorized by your bank

- Using multi-currency cards (N26, Revolut, Wise) that offer free payments

- Have a bank account in EnglandThis can be advantageous if you are staying in London or the country for a long time.

What are the best cards to use in England?

With free, unlimited withdrawals, N26 pulls through and is an excellent choice. Revolut is also attractive, despite a limit of 5 free withdrawals. As for WiseThis option is subject to a small exchange fee, but allows you to withdraw up to £200 free of charge (in 1 or 2 withdrawals).

Clearly, these solutions are more advantageous than those offered by traditional banks, and you might want to look into them for your next trip, to London or elsewhere!

Can I withdraw money easily in England?

Yes, there is ATMs everywhere. But beware of the fees your bank may charge for each withdrawal.

A little tip In supermarkets, you can ask for a cashbackIn this way, you can add a sum to the bill paid by card (e.g. £20) and receive it in the form of cash. Although this method is gradually being lost, it's one you should be familiar with, and can prove very useful.

What to do in London in 1 day, 2 days, 3 days, 5 days, a week?

Whatever the length of your stay, I invite you to download my special London guide.

It's free and in PDF format.

All you have to do is tell me below which e-mail address you'd like to receive it at.

EDIT: you can't enter your email?

Take the quiz at the top of this article and you'll be able to register your email address to receive the special London guide!

Travelling to London for 5 days, what to do?

Here are the best things to do in London: https://bonjourlondres.fr/que-faire-a-londres/